On Trend with Nearby McIIVenna Bay VMS Deposit that is on Path to Production

About Denare West

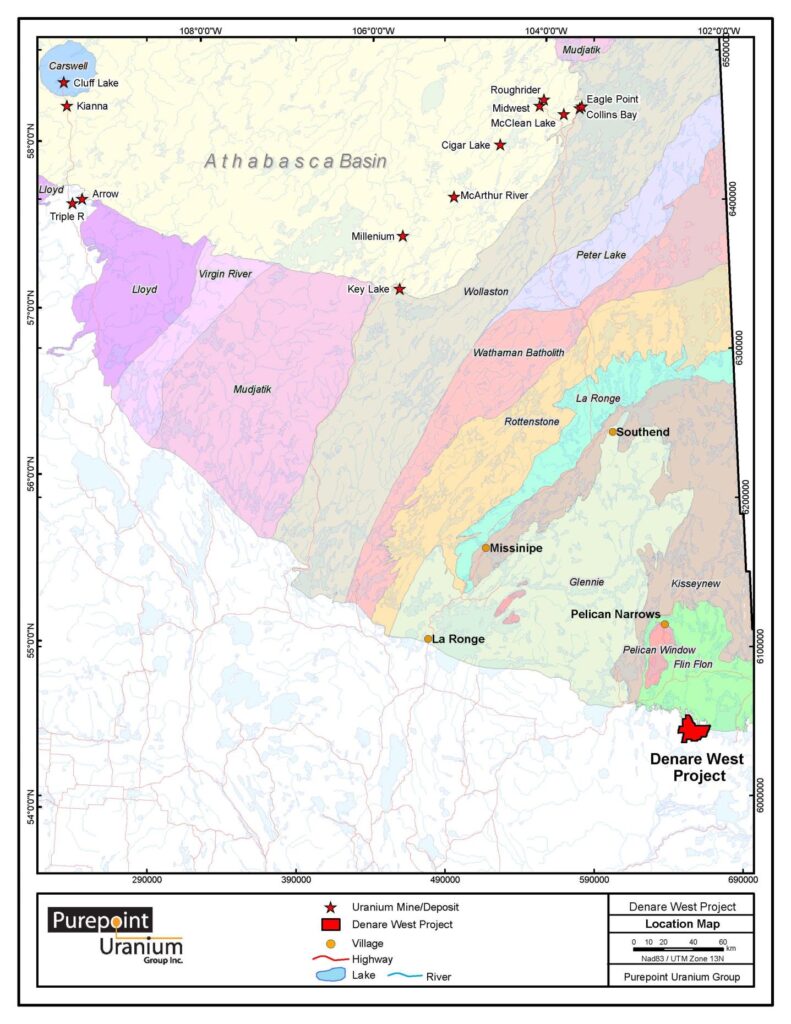

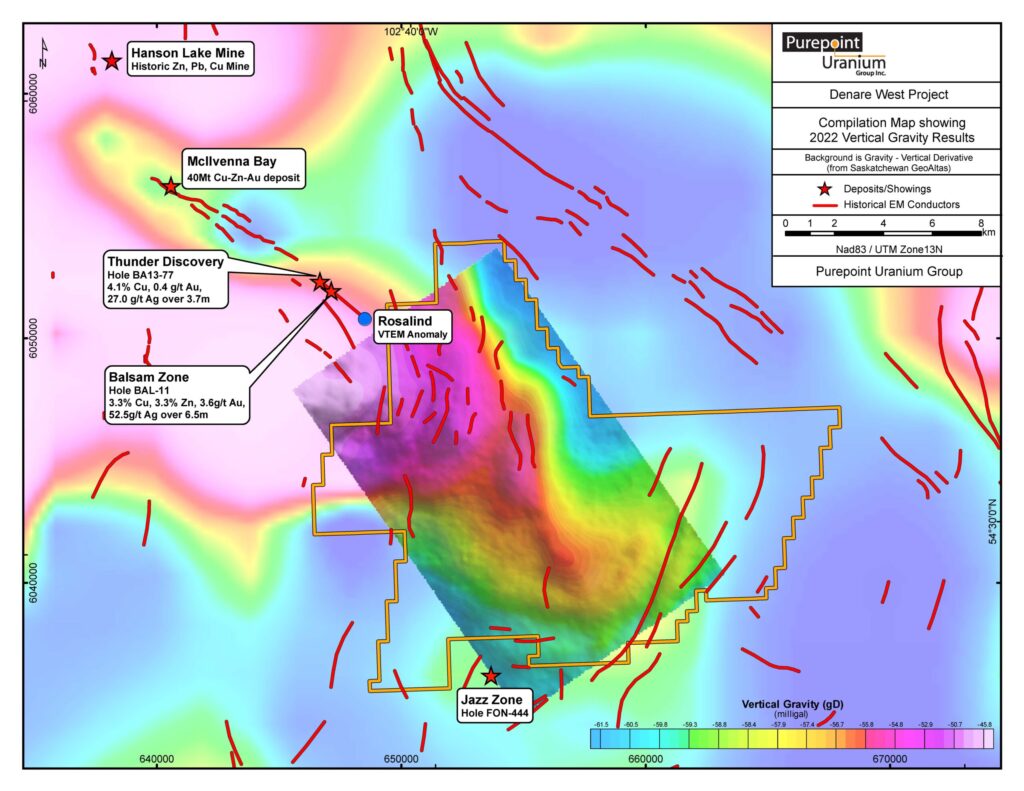

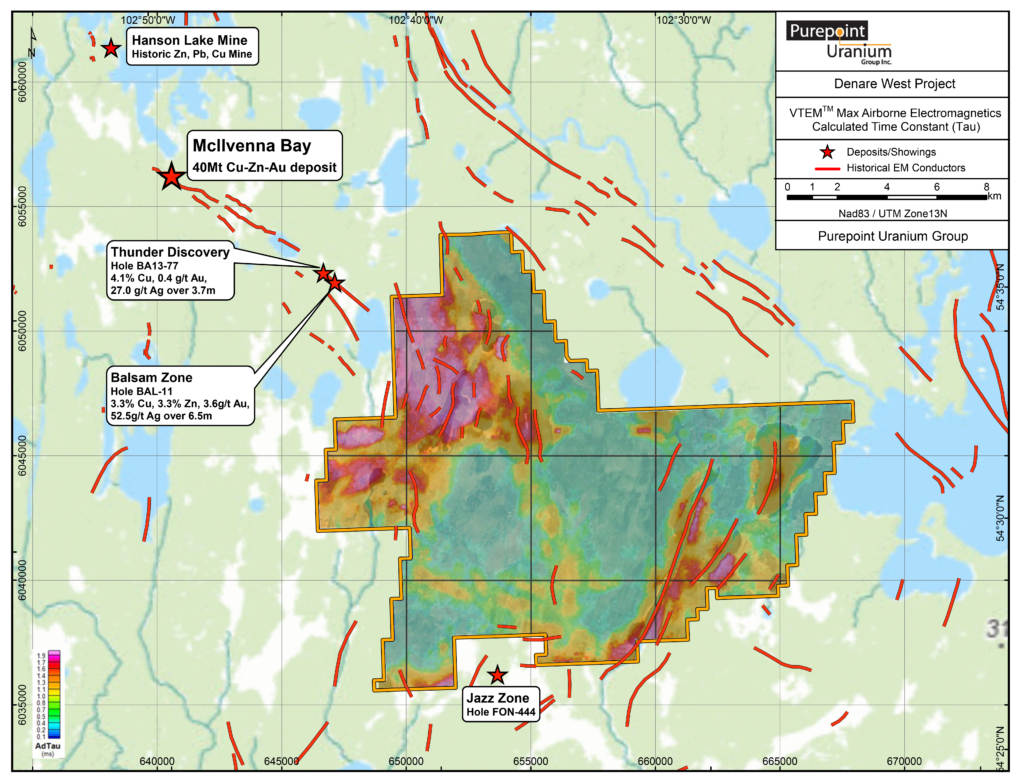

The Denare West Volcanogenic Massive Sulphide (VMS) Project, located in east-central Saskatchewan, roughly 55 kilometres west-southwest of Flin Flon, Manitoba, was identified by Purepoint in 2018 as a highly prospective and valuable base and precious metal exploration opportunity that was on strike with the Hanson Lake and McIlvenna Bay deposits. It comprises of 10 claims covering an area of 21,066 hectares in the Hanson Lake area.

The McIlvenna Bay deposit being advanced by Foran Mining is located 9 kilometres NW from the Denare West project and has indicated resources of 39Mt grading at 2.04% copper equivalent (Foran’s Technical Report dated November 25, 2021).

In November 2023, Purepoint entered into an option agreement with Foran Mining for the Denare Project.

Pursuant to the Option Agreement, Foran has been granted the option (the “First Earn-in Option”) to acquire a 51% beneficial interest in the Property by incurring a total of $3,000,000 in qualifying exploration expenditures (“Expenditures”) on the Property over a period of up to four years from the effective date of the Option Agreement (the “First Expenditure Period”).

Following the exercise of the First Earn-in Option, Foran will have the option (the “Second Earn-in Option”) to acquire an additional 29% beneficial interest in the Property by incurring an additional $3,000,000 in Expenditures on the Property over a period of up to two years following the end of the First Expenditure Period.

Following the exercise of the Second Earn-in Option, Foran will have the final option to acquire the remaining 20% interest in the Property by making a payment in the amount of $10,000,000 (the “Final Purchase Option Price”) to Purepoint and granting a 2% net smelter returns royalty (“NSR”) to Purepoint.

Foran has a multi-stage option to buy back the NSR royalty from Purepoint: initially, it can repurchase 1% NSR for $1,000,000 (the “First Royalty Option”) at any time before deciding to operate a mine commercially on the Property. Following this, subject to exercising the First Royalty Option and after 60 months of NSR payments, it has the option (the “Second Royalty Option”) to buy an additional 0.5% NSR for another $1,000,000. Finally, after 120 months of NSR payments and exercising the Second Royalty Option, it can acquire the remaining 0.5% NSR for $1,000,000 (the “Final Royalty Option Price”).

Subject to the stock exchange approval and satisfaction of certain other conditions set out in the Option Agreement, Foran may pay the Final Purchase Option Price, the First Royalty Option Price, the Second Royalty Option Price and the Final Royalty Option Price by issuing common shares (“Foran Shares”) to Purepoint at a deemed price per share that is equal to the 20-trading day volume weighted average price of Foran Shares immediately preceding the date of the notice of exercise of the applicable option.

At the end of the earn-in phases, if Foran does not elect to acquire Purepoint’s remaining interest in the Property, Foran and Purepoint will form a joint venture (the "Joint Venture") whereby Foran will fund all operations of the Joint Venture until it completes a pre-feasibility study with respect to the Property.